When consultancies grow, they typically endure a series of crises on the way. And often these arise when the things that have made the firm really successful thus far turn into the things that are holding it back. In this article, we look at five crises and how to overcome them so you can power ahead.

1 Overhead crisis

Occurs: when you have 5-30 people

Every business has admin overheads, and it can be hard to keep them matched to the business. There are two points where this problem can be particularly acute: when you’re still small, and when you reach about 30 people.

Small firms

Surprisingly often, we come across smaller consultancies that have more back-office staff than active consultants. It’s easy to end up with an office manager, PA, marketing manager, resourcing manager and finance manager. Having all this support can create a comforting big-company feel. It may project an impression to clients that you’re bigger than you are - but may also require a budget that’s bigger than yours really is.

Check the proportion of your profits that you’re spending on overheads. Is it appropriate? The risk is that you’re investing in overheads, rather than in hiring talent and building the intellectual property that will attract and win new customers.

The remedy is to cut overheads down to the bare minimum, and go virtual wherever possible. Virtual support means you don’t need to provide office space (which will reduce your rent and the need for an office manager) and may make it easier to use flexible serviced office space that can flex with your needs. Or go one better: with software that allows you to self-serve on things like expenses, meeting bookings and resource management, you won’t even need outsourcing. The cash you’ve saved on overheads can fund new talent instead.

Larger firms

Once you’ve grown further and started to need dedicated staff, you need space for them to work. You transfer from outsourcing to employing people, and they require more formal management including line management.

The answer is to stay virtual for as long as you can, and taper in full time back office staff one at a time, so that you don’t take on too much overhead in one go. As you continue growing, the impact of these additional overheads becomes diluted, and is a challenge rather than a crisis.

2 Spreadsheet crisis

Occurs: when you have 10 people or more

Spreadsheets are the ideal way to run a small firm. They’re free, flexible and easy to get started with. But that freedom and flexibility become a liability as you get bigger.

Firstly you find that your data becomes fragmented across multiple spreadsheets. You have multiple versions of the ‘truth’.

Secondly, spreadsheets stop being ‘free’ as they take increasing amounts of time from you or your team to make them work.

Finally, they don’t give you the insight you need to manage a growing business. You can find yourself discussing the data, not the issues.

Businesses often swap out some of the spreadsheets for a mix of independent timesheeting, expenses and other software. This is a temporary sticking-plaster that generates high costs and still makes it difficult to bring together insight about the business into a single place.

Extra profitability

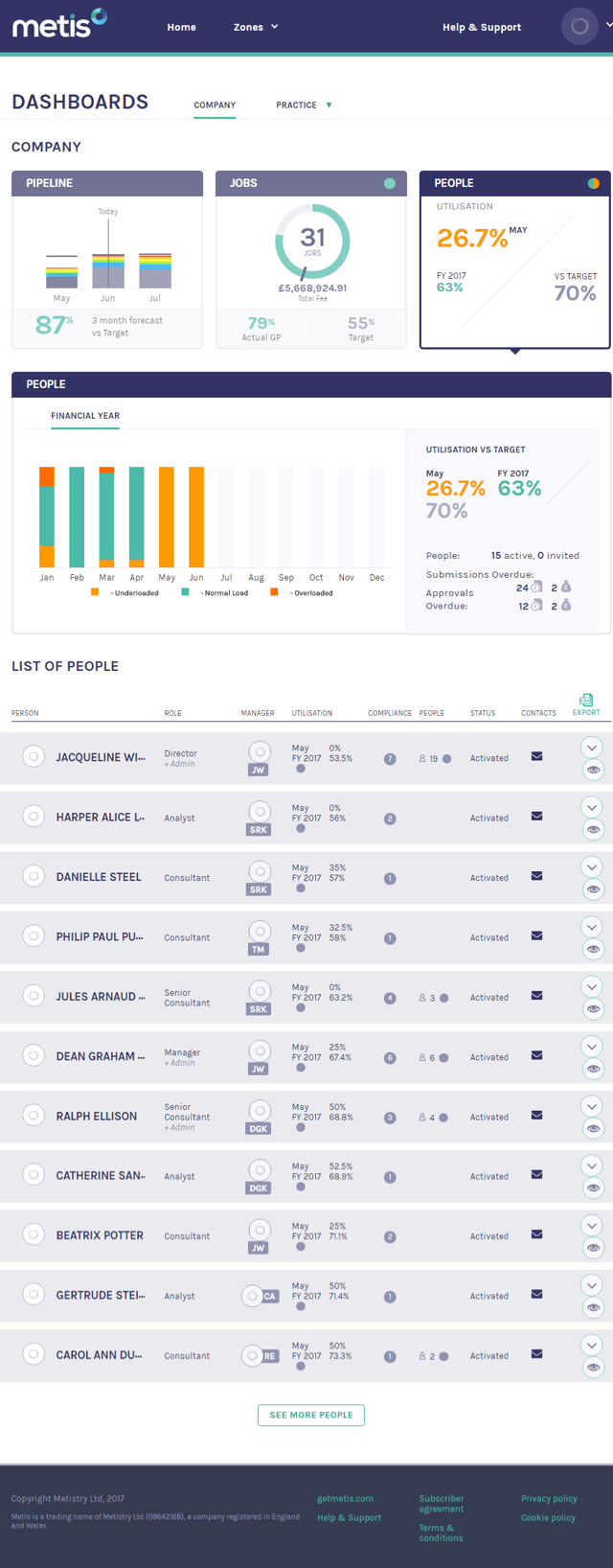

We think 10-15 staff (freelancers and associates) is the point where the downsides of this fragmented approach start to outweigh the upsides. The solution is to move to specialist software like Metis that helps you manage your whole business in one place and focus on the things that will drive the next stage of growth. It’s a smart investment: like picking an account with compound interest, using specialised software has a cumulative positive effect as it gives foresight that enables you to generate extra profitability . Sooner is definitely better. A glance at a Metis dashboard will show you your priorities in real time.

3 Micromanagement crisis

Occurs: when you have 10 people or more

Sometimes people who have made it this far with their firm turn out to be those who have their finger on the pulse. Of everything.

That’s a fantastic trait when the business is small: it means the founders are in control and clients are getting consistently high quality across all projects. But as the business grows, its complexity starts to exceed the span of control of any one partner/director. It’s a classic case of an over-used strength becoming a weakness. Smart leaders know that this is the point at which they need to start delegating. Unfortunately, knowing that and being willing to do it are two different things.

Warning signs

Signs of problems are project deliverables, proposals and internal processes that are stuck because directors need to sign off on them. They want to change and iterate things, often well past the point where they should have moved on - and this affects responsiveness and client delivery. The result is client dissatisfaction and team frustration.

Also, if directors are filling all their time with micro-control points, they probably aren’t spending enough time on finding the ideas, clients and talent that are going to drive the business forward. They could even put a stop to promising new service lines that are outside their direct experience.

Terrifying

The terrifying (for directors) solution is delegation. That means deliberately growing a next tier of management to whom accountability can be delegated. It may also mean taking a leap of faith and asking people to step up. In terms of the delivery of work, this can start gradually, perhaps by having senior managers do the initial quality checks on all client deliverables. As the senior team prove they’re up to the job, you gradually give them more trust and responsibility. .

The buck stops with you

Of course, the buck still stops with you. How do you check up on jobs when you’re no longer directly involved? You need ways to monitor the progress and success of projects, clients and staff. That means tools that enable your delegates to manage sales, job profitability, and the delivery teams around them. And that give you, as a partner or director, an overview so you can spot problems early and intervene if a manager needs help.

After we’d run consultancies ourselves and not found software that did this job adequately, we created Metis, a system that’s easy for managers to use and shows partners/directors the analysis they need, in real time, to keep their business on track. It gives the reassurance you need, if you’re anxious about stepping back from close involvement in everything your firm does.

Solving the delegation crisis is the start of a virtuous circle of being able to manage a larger amount of successful work, having more director time to win new business, and having a more exciting environment for new talent to join.

4 Sales and growth crisis

Occurs: when you have 30 people or more

The sales and growth crisis happens when all the selling in a business is done by a small number of people, and they reach the limit of what they can sell.

It’s common for consulting firms to rely on the sales efforts of a small number of people. There’s an upper limit to what they can achieve. Firms in this position find that despite a great team, happy customers and strong processes, growth stalls.

What to do? We recommend a number of things:

- Look at what you sell to see if it’s possible to increase the sales capacity of your stars. Can you change focus, approach or market to sell what you do in bigger chunks, for instance, selling strategy and implementation together? This is a different way to look at upselling and cross-selling, with their well-known benefits.

- Delegate and train the next level down to take more responsibility for sales. In addition, make your senior consulting team responsible for farming existing clients while your stars sell new work to new people.

- Form partnerships with complementary firms. You could combine to bid for projects that neither firm would have the scale or skills for on its own. Or, if you’re experts in a niche, partner with a bigger generalist firm to bring some extra ‘pixie dust’ to something they are bidding for.

We’ve written more about how to make selling easier here.

Another option that people sometimes consider is to go out and hire a new ‘rainmaker’. We’re much more cautious about this. It’s not that it can’t work, but we haven’t ever seen it happen in practice. Very few people bring a ready-made network of new customers all set to buy from you - if they had that, wouldn’t they set up their own firm? And if they do join you, they’ll rightly be commanding a massive premium.

5 Leadership crisis

Occurs: typically when you have 40 people or more

This crisis happens relatively rarely, compared to the others we’ve discussed. It’s when the people who started the business aren’t the right people to lead it as it gets to a serious size. (It can afflict firms of any size, but is typical at 40+.) It can happen for several reasons:

- The original leaders may be visionaries who are brilliant in their field but less adept at (or even interested in) the management that’s needed to run a medium-sized business.

- If you’ve got to this size, you’ve probably been running the business for a while. Some of the founders might be weary and looking to change tack.

- A change of strategic direction may require you to bring in new people to fill out gaps in skills and expertise.

Conversations about addressing a leadership crisis are likely to have a significant emotional component to them and need to be approached carefully.

Options for moving forward can include any of these, at the appropriate time:

- Buying out leaders who either want to go or who no longer add sufficient value.

- Finding new ways for people to serve, perhaps by stepping back from front-line leadership and focusing on intellectual property and client work. This may involve changes in incentivisation too.

- Including the next layer of management in the equity structure to give them a voice and secure a succession.

- Merging or selling the business.

- Hiring new leaders (though, as discussed above, that’s often difficult to get right).

Way out

One other matter to think about, regardless of the size your firm has reached, is structure and incentives. It’s very difficult to get shares back from people once they’re allocated. If people aren’t prepared to be bought out at a fair price then they may be able to continue to take dividends, and perhaps have voting rights, without contributing, which can land you in the soup. Things to think about include:

- Creating short- and long-term incentive plans that allow you to retain and grow staff who are potential directors/partners.

- Using an Limited Liability Partnership (LLP) structure for your business. These very flexible structures have a number of advantages for consulting firms, including tax savings, ease of changing senior team structures and simplified ways to create long-term incentive plans.

- Having shareholder or LLP agreements that clearly define what happens when someone wants to leave or join the ownership of the business. Ideally this should be agreed well before you need to rely on its terms.

Crunch point

Any one of these 5 crises could sink a small business, through cash, time, effort or talent being squandered. Avoiding or resolving them can be straightforward. If you’re facing a crunch point, call us for a chat. And do share your views.