Every consultancy has a set of measures that they use to keep score. In fact, for every 10 companies we speak to there are about 12 different perspectives on what the right measures are. In this blog we make the case for why profitability should be your ‘One Metric to rule them all’.

Every consultancy has a set of measures that they use to keep score. In fact, for every 10 companies we speak to there are about 12 different perspectives on what the right measures are. In this blog we make the case for why profitability should be your ‘One Metric to rule them all’.

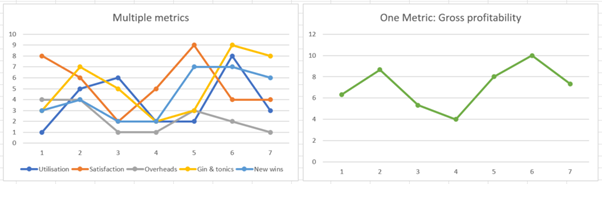

In our view, some firms try to measure far too much whilst others focus on the wrong things.

There are two things going on here. The first is that having too many numbers to review and measure is a problem. Producing all that data creates overheads, and then trying to decide which numbers are most important can be a source of mental friction. The second is that, if you have many numbers to track, it can be hard to set and communicate a single focus for everyone to align behind.

Communicate and decide

We like the new thinking that has emerged from the fast-moving world of digital product design: One Metric to rule them all. In this model, there is a single measure that defines how well the organisation is doing. You can still measure other things, but they’re there to provide context and explanation around the One Metric. If you have only one thing to focus on then it’s very easy to communicate. And it’s easy to base your decisions on how they’ll impact that metric over the short and long term.

We’d like to convince you that the One Metric for your firm should be gross profitability - the gross margin made from client work before deducting the costs of back-office staff or rent.

Why are we so sure about this? It’s not just because we know the old saying: “Revenue is vanity, profit is sanity”. There are lots of good reasons:

- You are in business to make profit, not revenue.

- Extra profit opens up possibilities for investment in people and ideas that make the business better and more exciting to work in. This, in turn, makes it easier to hire great people.

- Greater profits can help if you ever run into cashflow challenges.

- Managing profitability drives the right behaviour in your team at every stage, from choosing what to bid for, through to the sort of in- and post-project reviews you do. For example, you’ll make better decisions about which projects to take on if you look at the likely profitability - rather than just revenue - as part of the proposal-writing process.

- Big-spending but high-maintenance clients are often high on revenue but low on profitability. You might see their future differently if you focus on profit first.

- If everyone in the team is managing the gross margin on the jobs they’re delivering, then overall gross margin should be under control. Which means that, if the rest of your costs are fixed, then your overall net margins should be highly predictable too, allowing you to plan for the future.

The 6-step guide

So what does it take to manage your business this way? Here’s our 6-step guide to adopting gross profitability as your One Metric.

- We suggest you define a standard gross margin for every project to meet or exceed. Make it the rule that every proposal must meet this minimum threshold unless the management team have specifically made an exception, perhaps in order to invest in a new client. If you do offer a discount, always provide free days rather than reduce the rate. Once you set a precedent with a low rate, you’ve set the client’s expectations, and it’s very hard to push it back up again.

- Agree a standard cost per hour/day for your team and make it available to anyone who plans and runs jobs. For freelancers that’s just their actual cost to you. For staff it might be salary plus on-costs and a contribution to overhead. If you feel that reveals too much about individual salaries then define a standard cost rate for each grade or function, based on weighted averages.

- Price jobs based on hitting your target margin. Unless the expenses are trivial, include their impact. If they’re significant and passed through without a markup, or if they’re not recoverable at all, they’ll dilute your margin.

- Calculate the margin on fixed price jobs simply by comparing the price that you’re proposing to charge the client with the input costs using your standard rates. You no longer need to think in terms of an implied day rate for each person.

- Track the profitability of jobs each week/fortnight by comparing the original plan with the amount of effort your team are actually putting in. Hold a regular ceremony in your business that reviews the profitability of live jobs and takes action on any that appear to be going off-piste.

- For additional insights, roll up your gross profitability to the client, job lead and company levels.